how long does it take the irs to collect back taxes

However if the IRS does not refile. Ad Owe back tax 10K-200K.

Federal Guidelines For Garnishment Turbotax Tax Tips Videos

Tax bills of less than 50000 take 4-6 months.

. Whether the winner would choose an annuity or the reduced lump sum taxes would take a big bite out of the prize. That statute runs from the date of the assessment. How long does it take IRS to collect payment once taxes have been filed online and accepted.

Ad Owe back tax 10K-200K. The Internal Revenue Service has a 10-year statute of limitations on tax collection. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

This means that the IRS can attempt to collect your unpaid. Owe IRS 10K-110K Back Taxes Check Eligibility. After that the debt is wiped clean from its books and the IRS writes it off.

This allows the IRS to contact the bank on your behalf to attempt recovery of your refund. How Long Does The IRS Have To Collect Back Taxes. However if you are getting notices from the IRS and you are wondering if they will ever go away the answer is yes.

Tax bills of more than 50000 take 7-12 months. Yet more would likely be due to the IRS at tax time. Just a very very long time.

Banks are allowed up to 90 days from the date of the initial trace input to respond to. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. The direct debit will occur on or after the date you specified when you selected.

Ad We Can Help You Reach an IRS Debt Forgiveness Program with the IRS. This means that the IRS cannot collect tax debts that are more. If you do neither we will proceed with our proposed assessment.

Contact Our Experts Today. They will not start taking anything out until about 30 days after. Apply For Tax Forgiveness and get help through the process.

June 4 2019 600 PM. How long does IRS have to collect back taxes. See what help is available and if you qualify for tax debt relief.

This is known as the statute of. Annuity payout after taxes. The overall odds of winning a prize are 1 in 249 and the odds of winning the.

Once a lien arises the IRS generally cant release the lien until the tax penalty interest and recording fees are paid in full or until the IRS may no longer legally collect the tax. The IRS has a 10-year statute of limitations during which they. If you leave the country for a period of 6 months or more then the IRS has at least 6 months after you return to attempt to collect the debt.

This is true even if the statute of. You will have 90 days to file your past due tax return or file a petition in Tax Court. The tax lien will still expire at the end of 10 years even if the IRS has more than 10 years to collect unless the IRS timely refiles the lien.

The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection. OICs must be finalized within 2 years after the IRS receives the OIC. The Internal Revenue Service the IRS has ten years to collect any debt.

See if you Qualify for IRS Fresh Start Request Online. Statute of Limitations on IRS Debt Collection. The IRS generally has 10 years from the date of assessment to collect on a balance due.

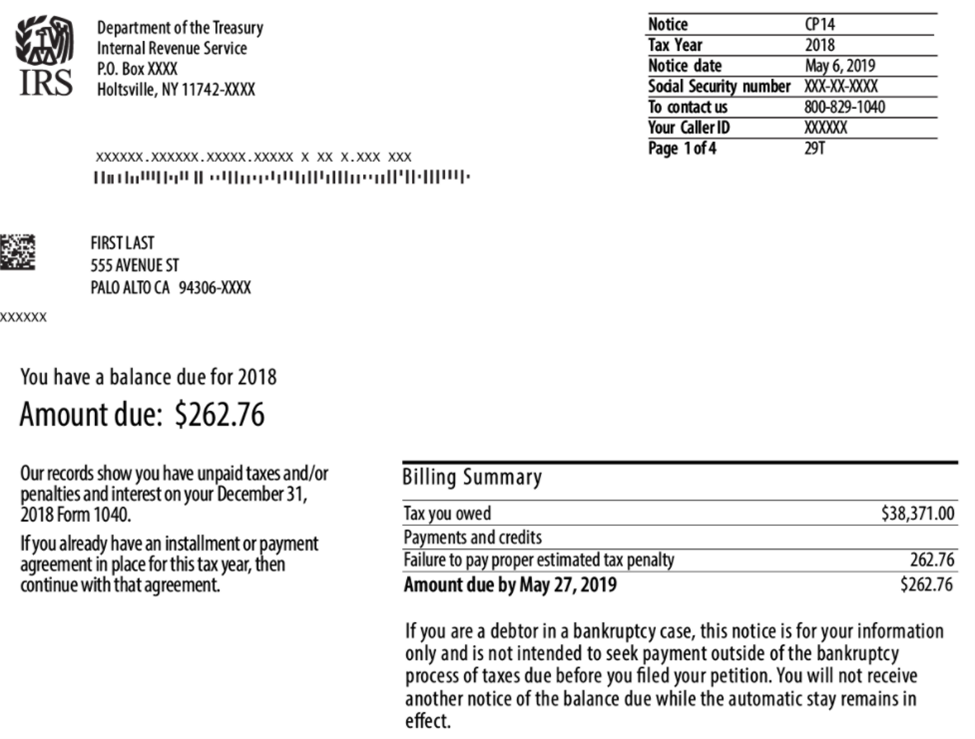

There is an IRS statute of limitations on collecting taxes. The IRS statute of limitations period for collection of taxes the IRS filing suit against the taxpayer to collect previously assessed taxes is generally ten years. The IRS will send you a bill with all the information you need after they process your return.

In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. After that the debt is wiped clean from its books and the IRS writes it off. While the 24 federal tax.

If you have received notice. Lump sum payout after taxes. Can the IRS go back more than 10 years.

Ad Learn what you can do if you owe back taxes and the many options you have. As a general rule there is a ten year statute of limitations on IRS collections. Assessment is not necessarily the.

If you paid personal income taxes in Massachusetts in 2021 and filed your 2021 Massachusetts tax return by October 17 2022 you are eligible to receive a 2022. Life Is Hard so We Make Tax Relief Easy. Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

Owe IRS 10K-110K Back Taxes Check Eligibility. See if you Qualify for IRS Fresh Start Request Online. This is called the 10 Year.

If the winner opts to take the full 1 billion in winnings over 30 years they will receive annual payouts of 333 million on average before taxes. After this 10-year period or statute of.

Tas Tax Tip Understanding Your Csed And The Time Irs Can Collect Taxes

Back Taxes Legal Ways To End Your Problems With The Irs Debt Com

What Does The Irs Do And How Can It Be Improved Tax Policy Center

Does The Irs Pay Interest On Late Refunds 11alive Com

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

How Does The Irs Collect Unpaid Taxes Wiztax

Asset Seizure What Assets Can The Irs Legally Seize To Satisfy Tax Debts

How Social Security Garnishment Works With Federal Back Taxes

/cloudfront-us-east-1.images.arcpublishing.com/gray/JM7FUVYTRFB3DH2TW4W7ZWNBWM.jpg)

The Irs Has A New Way To Collect Back Taxes Increasing Risk For Scams

What To Do If Your Tax Refund Is Wrong

How Long Does It Take Irs Collection Agreement H R Block

Collections Activities Penalties And Appeals Internal Revenue Service

How Long Does The Irs Have To Collect On Your Unpaid Tax Debt Youtube

Irs Bank Levies Can Take Your Money Debt Com

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

Best Way To Catch Up On Unfiled Tax Returns Back Taxes

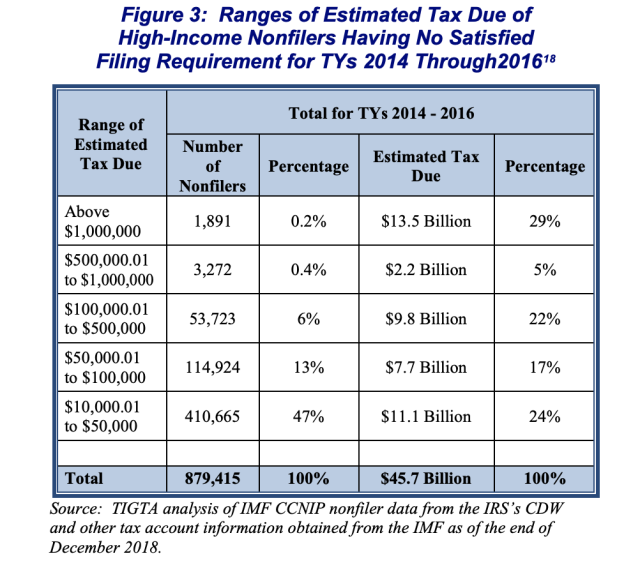

The Irs Is Failing To Collect Billions In Back Taxes Owed By Super Rich Americans